nh food sales tax

The cost of a New Hampshire Meals Tax Restaurant Tax is unique for the specific needs of each business. Maximum Possible Sales Tax.

Sales Tax On Grocery Items Taxjar

New Hampshire does collect.

. By Kristine Cummings August 15 2022 August 15 2022. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals. Some rates might be different in Nashua.

New Hampshire is one of the few states with no statewide sales tax. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. B Three states levy mandatory statewide local add-on sales taxes.

With Live Free as the first half of our state motto its only fitting wed offer tax-free shopping. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Free Unlimited Searches Try Now. Tax rate drops from 9 to 85. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New Hampshires sales tax rates for commonly exempted categories are listed below. New Hampshire is one of the few states with no statewide sales tax.

There are however several specific taxes levied on particular services or products. Below is a partial list of laws and rules pertaining to agriculture in New Hampshire. A bit of that money goes toward school building loans and tourism promotion.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. California 1 Utah 125 and Virginia 1.

No inheritance or estate taxes. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at. This is the Connecticut state sales tax rate plus and additional 1 sales tax.

Shopping in NH Tax-free shopping. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. A 9 tax is also assessed on motor vehicle rentals.

New Hampshire Sales Tax Rate New Hampshire is one of the five states in the USA that have no state sales tax. The Meals and Rentals MR Tax was enacted in 1967. No capital gains tax.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. However as agriculture is impacted by some regulations administered by other departments within New Hampshire State Government they are also provided here for. The state sales tax rate in New Hampshire is 0 but you can customize this table as needed to reflect your applicable local sales tax rate.

Federal excise tax rates on beer wine and liquor are as follows. A 9 tax is also assessed on motor vehicle rentals. There are however several specific taxes levied on particular services or products.

Wayfair decision earlier this summer has stripped New Hampshire retailers of a key advantage in place for decades. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. New Hampshire Guidance on Food Taxability Released.

Additional details on opening forms can be found here. The tax is collected by hotels restaurants caterers and other businesses. New Hampshire NH sales tax is currently 0.

1800 per 31-gallon barrel or 005 per 12-oz can. It is one of only 5 states without a sales tax. Most are directly administered by the Department of Agriculture Markets Food.

Is there a grocery tax in New Hampshire. New Hampshires meals and rooms tax is a 85 tax on room. The cost of a New Hampshire Meals Tax Restaurant Tax depends on a companys industry geographic service regions and possibly other factors.

New Hampshire meals and rooms tax rate drops beginning Friday. The Portsmouth New Hampshire sales tax is NA the same as the New Hampshire state sales tax. We include these in their state sales tax.

Ad Get New Hampshire Tax Rate By Zip. Fillable PDF Document Number. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions.

They send the money to the state. Average Local State Sales Tax. While many other states allow counties and other localities to collect a local option sales tax New Hampshire does not permit local sales taxes to be collected.

Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. A proof gallon is a gallon of.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Thats right you read that correctly. Is New Hampshire Tax Free Shopping.

At LicenseSuite we offer affordable New Hampshire meals tax restaurant tax compliance. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or. 1350 per proof-gallon or 214 per 750ml 80-proof bottle.

State State General Sales Tax Grocery Treatment. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Property taxes that vary by town.

Tax Rate Starting Price.

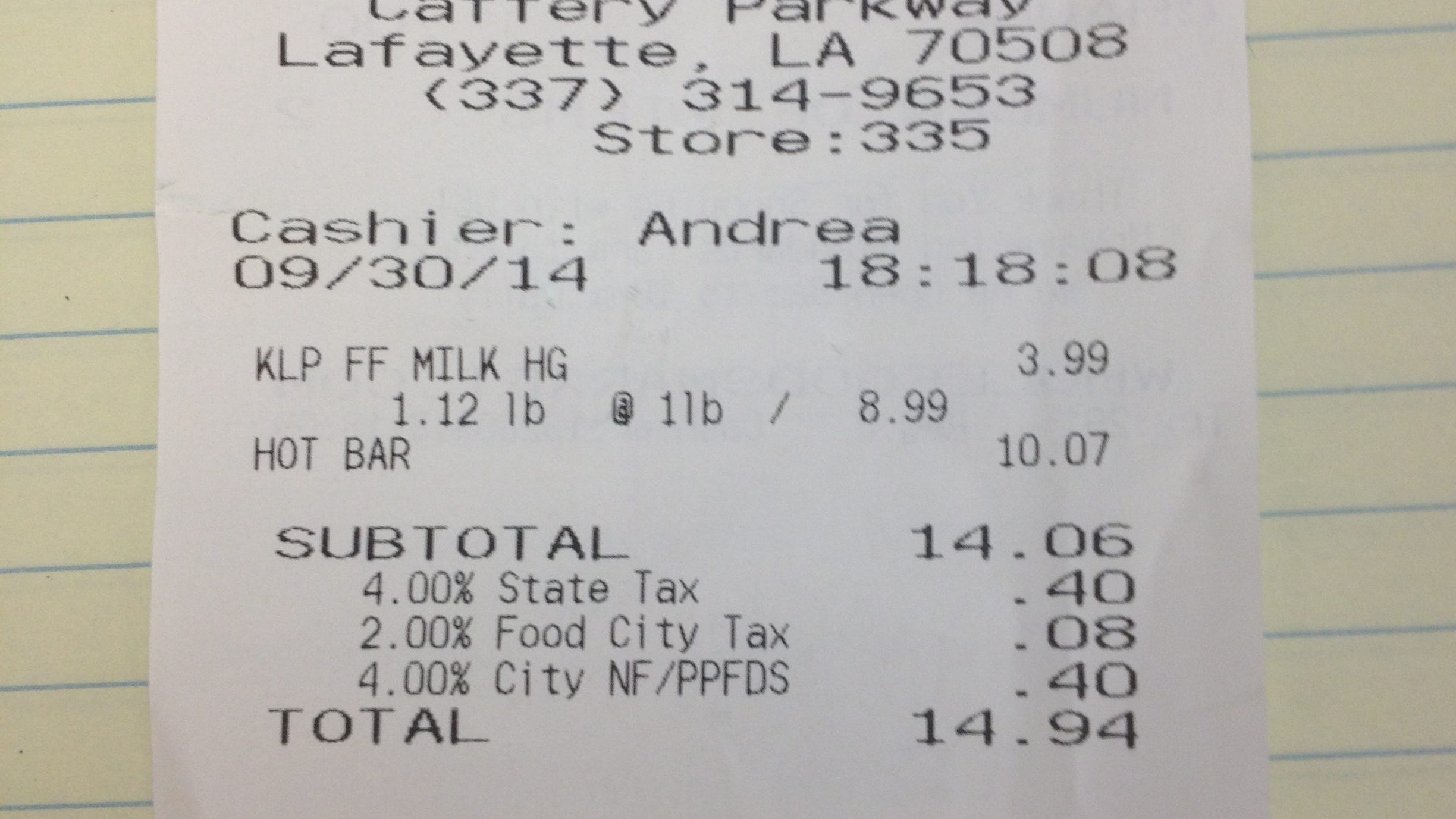

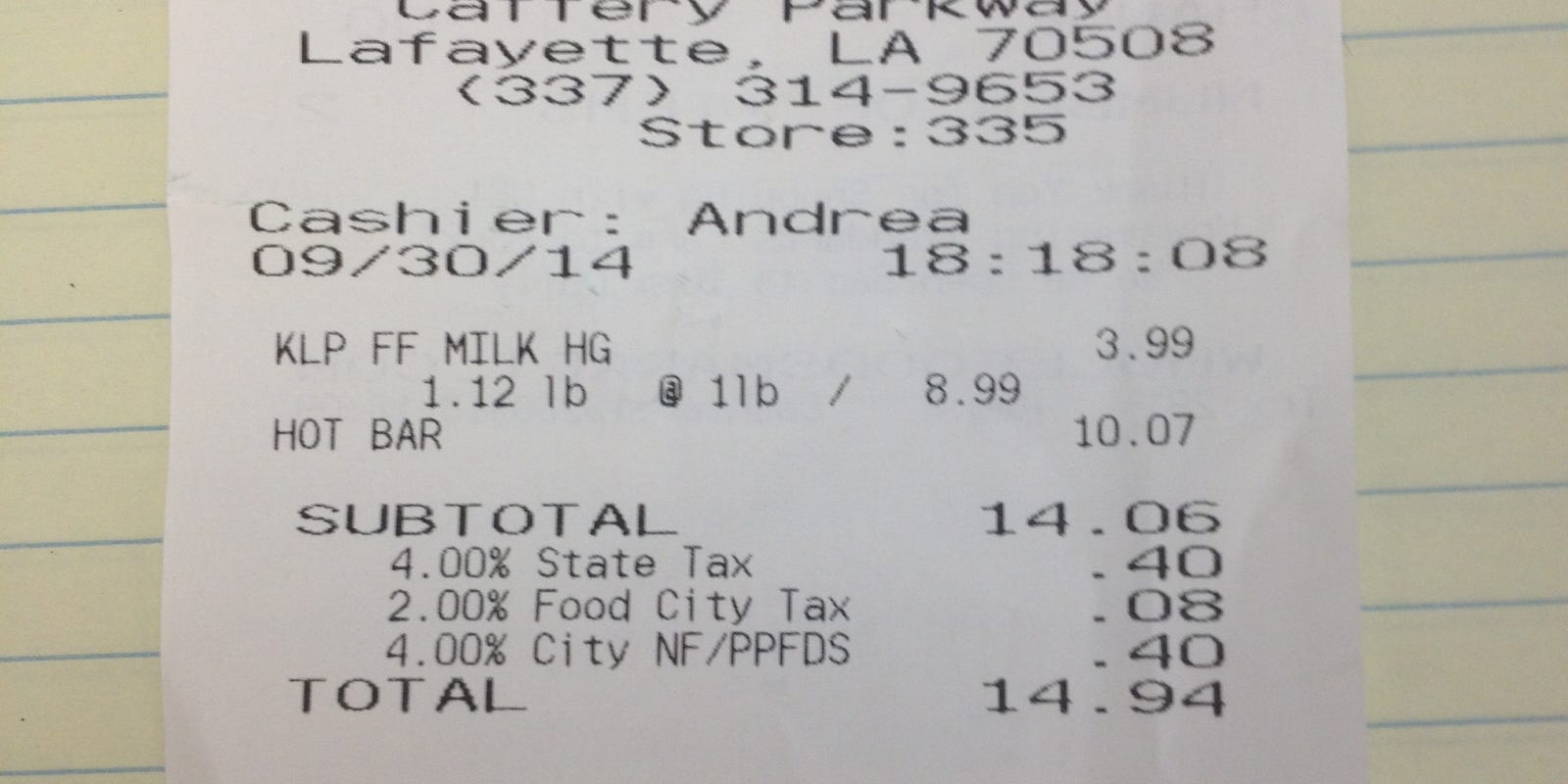

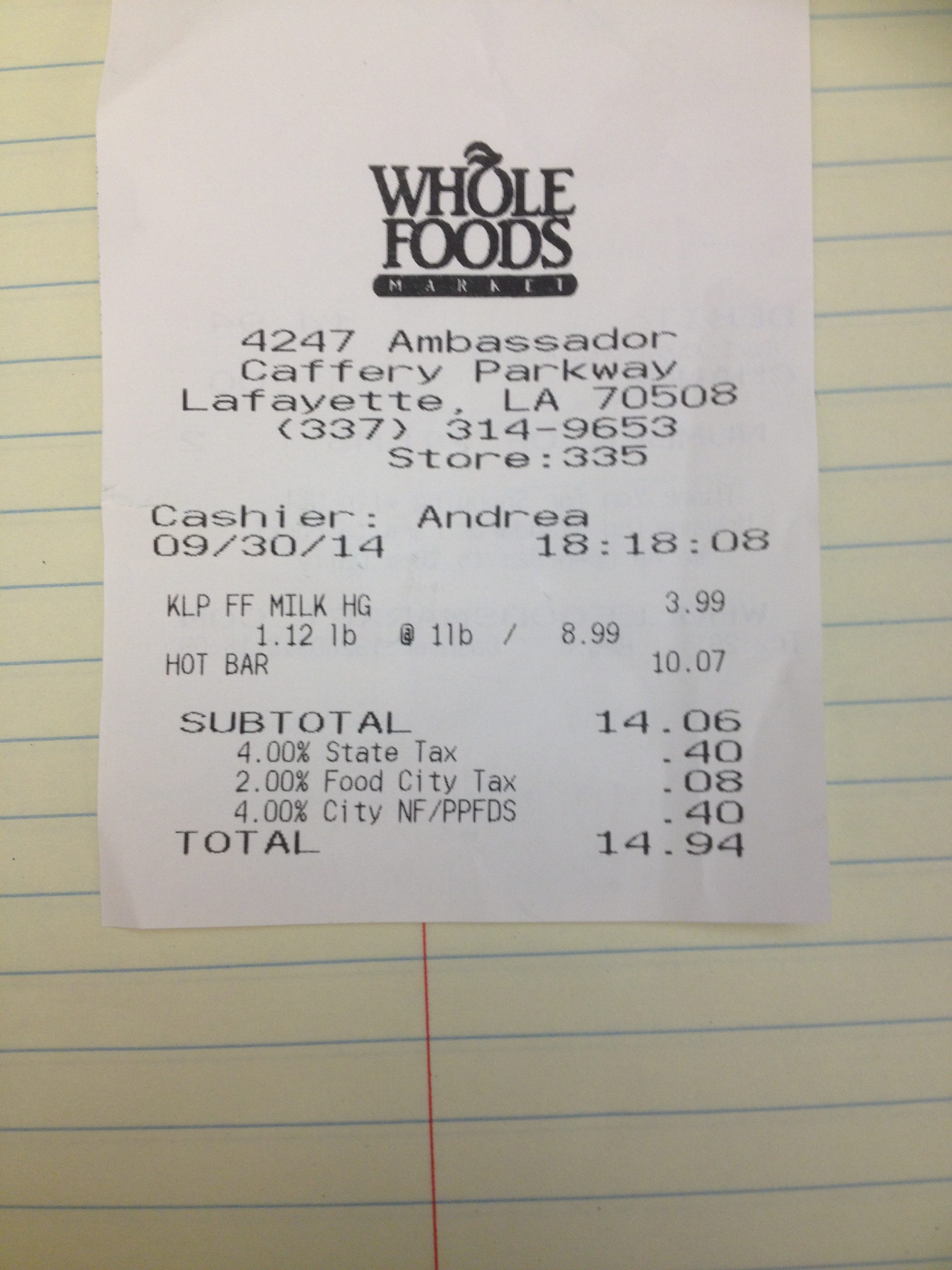

Whole Foods Collecting The Right Amount Of Sales Tax

Flush States May Exempt Food From Sales Tax

The Absolute Cheapest States To Retire In 2020 Zippia Work Family Dungeons And Dragons States

New Hampshire Meals And Rooms Tax Rate Cut Begins

Whole Foods Collecting The Right Amount Of Sales Tax

Http Www Nolo Com Legal Encyclopedia 50 State Guide Internet Sales Tax Laws Html Kansas Missouri New Hampshire Missouri

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

Residents Of New Hampshire Often Refer To One Of The State S Seven Geographic Regions When Describing Where They Li New Hampshire Best Places To Live Hampshire

Whole Foods Collecting The Right Amount Of Sales Tax

Flush States May Exempt Food From Sales Tax

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Pinned October 14th 3 Pack Churros Free With Any Purchase Today At Tacobueno Restaurants Thecouponsapp National Dessert Day Food Churros

Happy Fourth Of July Infographic Social Media Delivered July4th Happy Fourth Of July Fourth Of July 4th Of July Party

Wedding Tip Thursday How Dates And Times Impact Wedding Costs The Pretty Pear Bride Plus Size Bridal Magazine

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Pin By Joe Skaggs On Summer Time Orange Beach Alabama Vacation Alabama Vacation Gulf Shores Alabama